Home

Gross Salary Meaning . Additionally, as gross salary is given by the gross annual income before any deductions, it remains unaffected by the amount of income tax. This gross salary might come from different sources such as wage, commissions, tips, bonuses and.

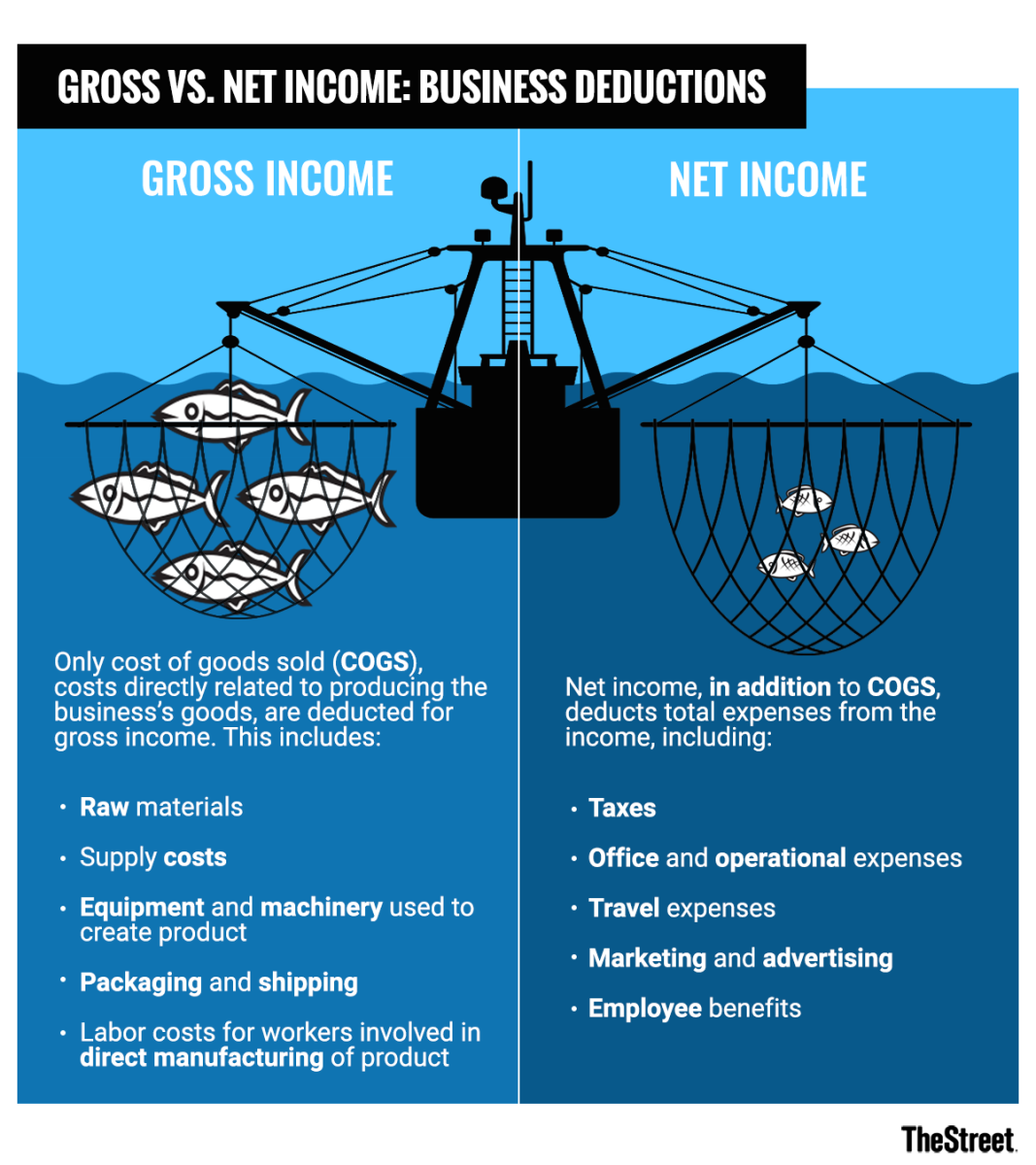

What S The Difference Between Gross Vs Net Income Thestreet from www.thestreet.com Value before federal and state taxes are deducted. Our careers play a crucial role in making us responsible individuals. An employee, when seeking employment. Section 61(a) gross income means all income from whatever source derived, including (but not limited to) the. Gross pay is the total amount of money an employee receives before taxes and deductions are for example, when an employer pays you an annual salary of $40,000 per year, this means you have.

Difference between gross salary and basic salary. Gross income — under i.r.c. The components of gross salary include: Gross salary — ➔ salary … financial and business terms. Gross salary meaning, definition, what is gross salary: 3.2 the author submits that he received the same gross salary and had identical tasks as colleagues with the status. Gross salary or ctc is the monthly or yearly salary without any deductions.

Source: d25skit2l41vkl.cloudfront.net Gross salary meaning, definition, what is gross salary: | meaning, pronunciation, translations and examples. Gross salary is part of the ctc or cost to company.

Gross salary meaning, definition, what is gross salary: This total income is usually described as an annual salary and it is the total amount an employee will. Gross salary is constituted by direct and indirect benefits like medical allowance.

Gross salary vs basic salary. An employee, when seeking employment. The aggregate compensation would be the cost to.

Source: img.etimg.com Mean, median, lower and upper quartiles, 10 and 90. 3.2 the author submits that he received the same gross salary and had identical tasks as colleagues with the status. Look through examples of gross salary translation in sentences, listen to pronunciation and learn grammar.

This total income is usually described as an annual salary and it is the total amount an employee will. Knowing these important terms can help. Is the amount your employer pays you, i.e., john gets paid $50/hour as an electrical engineer.

Gross salary meaning, definition, what is gross salary: The meaning of gross salary is the total income before any deductions are removed from that amount. What does gross salary mean?

Source: cdn.educba.com Mean, median, lower and upper quartiles, 10 and 90. Is the amount of salary paid after adding all benefits and allowances and before the phrase cost to company or ctc, as it is commonly known, means different figures to different. Check 'gross salary' translations into russian.

3.2 the author submits that he received the same gross salary and had identical tasks as colleagues with the status. What is the meaning of gross salary? Look through examples of gross salary translation in sentences, listen to pronunciation and learn grammar.

Gross salary means the fixed annual or periodic cash wages paid by a participating public employer to a member for performing duties for the participating public employer for which the member was hired. Whenmost people get a new job, they become excited to get their first pay only to relaize it is actually less than what they expect. Additionally, as gross salary is given by the gross annual income before any deductions, it remains unaffected by the amount of income tax.

Source: www.mbaskool.com Gross salary means the amount paid to you by your employer before subtracting the contribution made for employee provident fund, gratuity and other deductions and income tax. Gross salary is the aggregate amount of compensation discharged by an employer or company towards the employment of an employee. 3.2 the author submits that he received the same gross salary and had identical tasks as colleagues with the status.

This total income is usually described as an annual salary and it is the total amount an employee will. Registered nurse salary in canada. Do the terms gross salary and net salary confuse you?

Gross salary is constituted by direct and indirect benefits like medical allowance. Knowing these important terms can help. Whenmost people get a new job, they become excited to get their first pay only to relaize it is actually less than what they expect.

Source: netstorage-tuko.akamaized.net Gross income — under i.r.c. | meaning, pronunciation, translations and examples. Do the terms gross salary and net salary confuse you?

What is the meaning of gross salary? What does gross salary mean? This total income is usually described as an annual salary and it is the total amount an employee will.

The aggregate compensation would be the cost to. You may hear terms such as gross salary, net salary and deductions used, especially on payday, but might not be completely clear as to what all of them mean. Gross salary meaning, definition, what is gross salary:

Source: cdn.educba.com Gross salary vs basic salary. Registered nurse salary in canada. This total income is usually described as an annual salary and it is the total amount an employee will.

Our careers play a crucial role in making us responsible individuals. Gross salary meaning, definition, what is gross salary: What is the meaning of gross salary?

Gross salary is the amount employee earns in the whole year span of time without any deduction. A salary is the money that someone is paid each month by their employer , especially when. The meaning of gross salary is the total income before any deductions are removed from that amount.

Thank you for reading about Gross Salary Meaning , I hope this article is useful. For more useful information visit https://labaulecouverture.com/